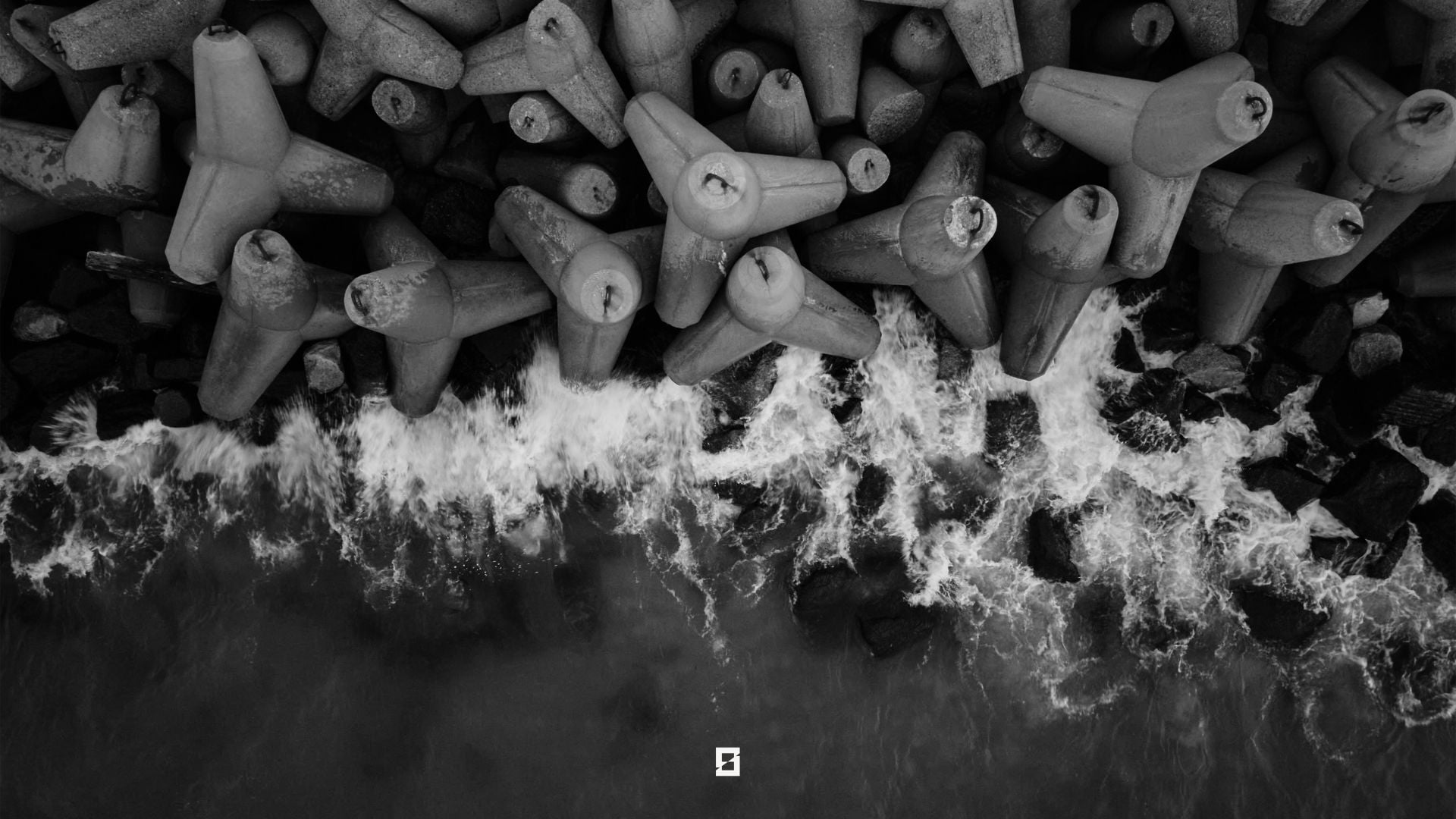

The Cook Islands are a group of islands positioned in the heart of the South Pacific Ocean. Nestled between New Zealand and Hawaii, this tropical archipelago spans a vast area North East of New Zealand.

Comprising 15 islands, each with its unique charm and natural beauty, the Cook Islands have become a sought-after destination for those seeking a tranquil escape in a tropical paradise. Situated approximately 3,000 kilometers (1,864 miles) southwest of Hawaii and 2,200 kilometers (1,367 miles) northeast of New Zealand, the Cook Islands boast pristine white-sand beaches, crystal-clear turquoise waters, and lush, vibrant landscapes.

The main population centers include Rarotonga, the capital, and Avarua, serving as the nation’s political and cultural hub. In addition to its geographical allure, the Cook Islands have cultivated a notable financial services industry, establishing the very first asset protection legislation in the early 80s. While the islands are renowned for their natural beauty and cultural richness, the financial sector plays a pivotal role in the economic landscape.

The Cook Islands have positioned themselves as a reputable offshore financial center. Offering a range of services, including banking, asset protection trusts, and international business entities, the Cook Islands is an attractive destination for those seeking financial privacy, security, and strategic wealth management.

Beyond its financial services, the Cook Islands maintain a harmonious balance, allowing residents and visitors to experience the best of both worlds — a tropical haven and a hub for sophisticated financial solutions.