$12,000

- Registered and operational Asset Protection Trust

- Operational bank account

- Registered and operational company

- Complete application process handled on your behalf

- Due diligence checks conducted as part of the service

- Drafting of country compliant trust and company documents such as the trust deed and operating agreement

- Coverage of all third-party (LLC and Trust related setup) costs, including first-year trustee and registration fees with the appropriate government body

Offshore Broker’s Total Protection Package is a comprehensive solution tailored to safeguard your assets and enhance financial privacy. This package includes:

- Offshore Trust: Shield your assets from legal judgments, creditors, and government interventions. Offshore trusts offer enhanced confidentiality and protection, ensuring your wealth remains secure and private.

- Offshore Company: An offshore company provides flexibility in managing your international business activities while still retaining the asset protection features made available with a trust.

- Bank Account: Enhance your offshore structure by incorporating a bank account featuring world-class multi-currency capabilities and diverse investment options.

The Benefits

- Asset Protection: The trust, coupled with the offshore company and bank account, offers a robust shield against legal judgments, creditors, and other potential threats. Assets held within this structure are safeguarded under the protective umbrella of multiple legal entities.

- Control and Management: The settlor/beneficiary retains control over asset management through the LLC or IBC. As the manager or director of the offshore company, the settlor can oversee the operations and utilization of funds within the associated bank account, ensuring efficient management aligned with the trust’s objectives.

- Privacy and Confidentiality: This structure prioritizes privacy and confidentiality, with the trust and company offering a layer of anonymity for the settlor/beneficiary. Offshore jurisdictions typically have strict confidentiality laws that protect the identity and details of beneficiaries and shareholders.

- Flexibility in Financial Transactions: The dedicated offshore bank account supports multi-currency transactions and offers diverse investment options. This flexibility enables efficient financial management and international transactions while minimizing currency exchange risks.

- Creditor Protection and Risk Mitigation: In the event of duress or legal challenges, the structure allows for swift asset protection measures. The trust’s ability to assume management of the company during such circumstances helps mitigate risks and protects assets from potential creditors.

- Legal Framework and Compliance: The package ensures compliance with offshore regulations and legal requirements. Establishing the trust, company, and bank account in reputable jurisdictions with well-regulated financial systems provides peace of mind and reduces regulatory risks.

- Continuity and Succession Planning: The integrated structure supports continuity and succession planning, allowing for seamless transfer of assets and management responsibilities in accordance with the trust’s provisions.

By combining a trust, offshore company, and bank account, the “Total Protection Package” offers a holistic approach to asset protection, financial management, and privacy in offshore jurisdictions. This structured solution empowers individuals and businesses to optimize wealth management strategies while safeguarding assets from external threats and uncertainties.

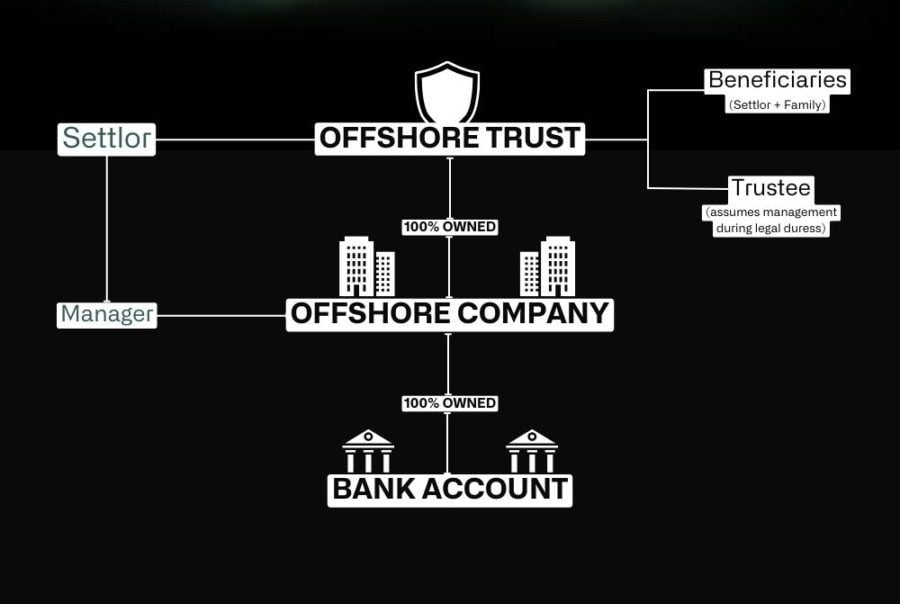

The Structure:

- Settlor(s): Initiates the trust and transfers assets into the trust structure. Defines the trust’s terms and appoints trustees to manage assets.

- Trustee: Manages trust assets according to the settlor’s instructions, acting in the best interests of the beneficiaries.

- Beneficiary(ies): Individuals or entities entitled to benefit from the trust’s assets and distributions.

2. Offshore Company (LLC or IBC):

- Member(s)/Shareholder(s): The trust can act as the member or shareholder of the offshore company, providing an additional layer of asset protection and confidentiality.

- Manager(s)/Director(s): The settlor can serve as the manager or director of the offshore company, responsible for decision-making, this allows for a degree of freedom when managing the trust assets.

3. Bank Account:

- Manager as Signatory: The manager or director of the offshore company acts as the signatory for the associated bank account, facilitating asset management and transaction authorization.

Additional Components:

- Protector (if applicable): Provides oversight to ensure the trust is administered in accordance with the settlor’s wishes and beneficiaries’ interests.

- Documents:

- Trust Deed: Establishes the terms and conditions of the trust, including asset management and distribution instructions.

- Articles of Incorporation/Operating Agreement: Outlines the governance structure and operational guidelines for the LLC or IBC.

- Registered Agent: Facilitates compliance and administrative requirements within the chosen offshore jurisdiction. This is included in your establishment fee.

FAQ: TOTAL PROTECTION PACKAGE

What is the role of the offshore trust in this package?

The offshore trust acts as a protective shield for your assets, shielding them from legal judgments, creditors, and government interventions. It ensures enhanced confidentiality and privacy for your wealth.

How does the offshore company complement the trust?

By incorporating an offshore company within this structure, you gain flexibility as the settlor-manager in managing the structure’s assets (such as the bank account) while leveraging the asset protection benefits provided by the trust.

What are the benefits of the dedicated bank account included in the package?

The bank account allows you to grow your wealth while it stays fully protected within the structure, giving you access to multiple currencies efficient international transactions and diverse investment options tailored to your financial objectives.

How does this package enhance financial privacy?

By utilizing multiple legal entities (trust and company) and banking in offshore jurisdictions, this package ensures a higher level of privacy and confidentiality compared to traditional onshore structures.

Can I customize the Total Protection Package based on my specific needs?

Yes, the package can be tailored to accommodate your unique asset protection goals, business requirements, and preferred banking arrangements depending on the jurisdictions and entity types available at the time. Be sure to check back regularly as our network of trustees, banks, investment managers and service providers grow.

Is the Total Protection Package compliant with international regulations?

Yes, the package is designed to comply with relevant international regulations governing offshore trusts, companies, and banking activities, ensuring transparency and legal compliance. We, along with our trusted partners, meet all the applicable KYC and AML obligations when setting up your entity.

CONTACT US

Please leave us a message, and a member of our team will respond to you shortly.

Alternatively, you can schedule a convenient time slot to discuss your asset protection goals with one of our specialists.